Your opensky® secured card is more than plastic—it's your path to better credit.

Let's get you set up for success with 5 simple steps

After your card arrives (12-14 business days)

Activate your card

Once you have your card, follow a few simple steps to activate it.

Enroll in online account management

This lets you make online payments, enroll in paperless statements, and more

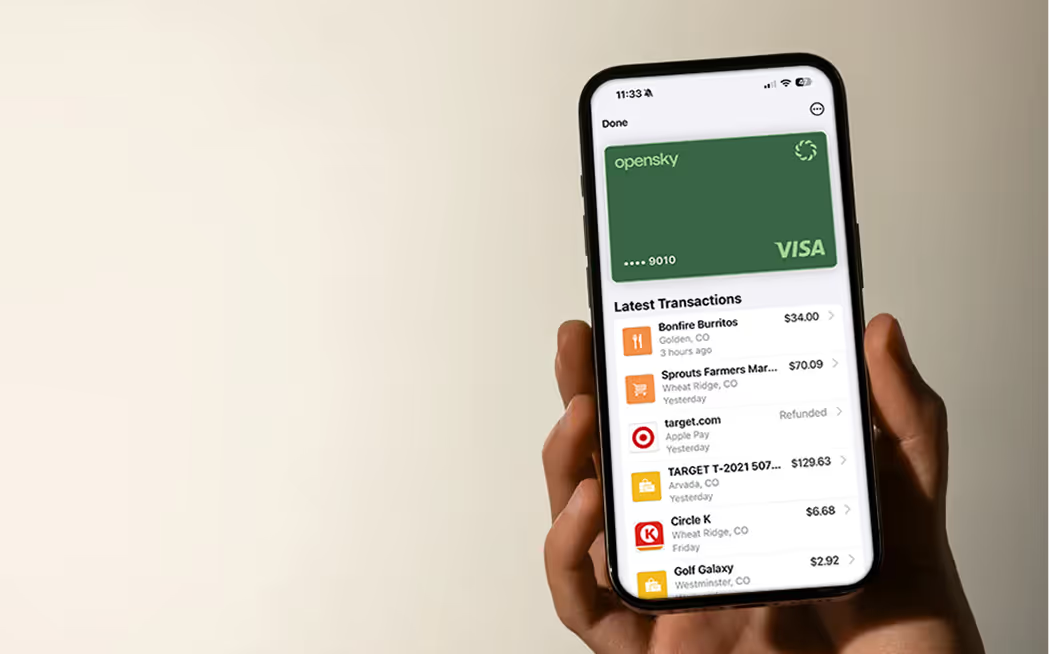

Download the mobile app, and turn on Autopay

Users who turn on Autopay are more likely to improve their credit scores.

Add your opensky card to Apple Pay and Google Pay

No more digging for your card in your wallet. Just tap your phone and go.

Enroll in FICO® to view your credit score for free

Opt in to FICO’s terms and conditions so we can track your score.

Credit building starts now!

Up to 10% cash back1 where it matters: Everyday spending

Credit building tips

Your opensky® card is more than just plastic—it's your tool for building better credit. Here's everything you need to know to make the most of it.

Frequently asked

How can I access FICO® Score for free?

Just follow these steps - online or on your mobile app to set up FICO® tracking:

- On the Account Summary Page, click on the "View FICO™ Score" button on the FICO widget or select "View FICO® Score" on Services Drop-down

- View FICO® Terms & Conditions screen

- To opt-in, simply click the "Agree" button

How can I set up text or email alerts?

To set up alerts:

1. Sign into opensky Mobile or go to “Sign In” on your computer

2. Select “Services” in the drop-down menu

3. Click “Alerts” from the navigation on the left

4. Choose when and how to stay informed

How can I set up Autopay?

Via the opensky Mobile App or online account management – you can sign up for Auto-Pay and schedule recurring, monthly payments, or set up one-time payments.

How do I add my opensky credit card to my mobile wallet?

Adding your card to your mobile wallet is simple. Open your preferred digital wallet app and tap “Add.” Then, either take a photo of your card or enter the details manually. Accept the terms and verify your card to finish setup.

How can I find the cash back rewards website?

To access the opensky Rewards site, login to your account or mobile app and select “opensky Rewards” from the dropdown. You’ll be taken to your personalized rewards page, where you can browse offers using the search bar and filters, and discover deals near you with the local offers map.

.svg)

.avif)

.avif)

.avif)